From the National Corn Growers Association:

US soybeans and corn are prime targets for tariffs. As the top two export commodities for our country, together they account for about one-fourth of total US agricultural export value. As such, a repeated tariff-based approach to addressing trade with China places a target on both US soybeans and corn. Farmers and rural economies pay the price as a result.

The report’s main conclusion (read the whole study for assumptions, model, etc.):

Study Findings

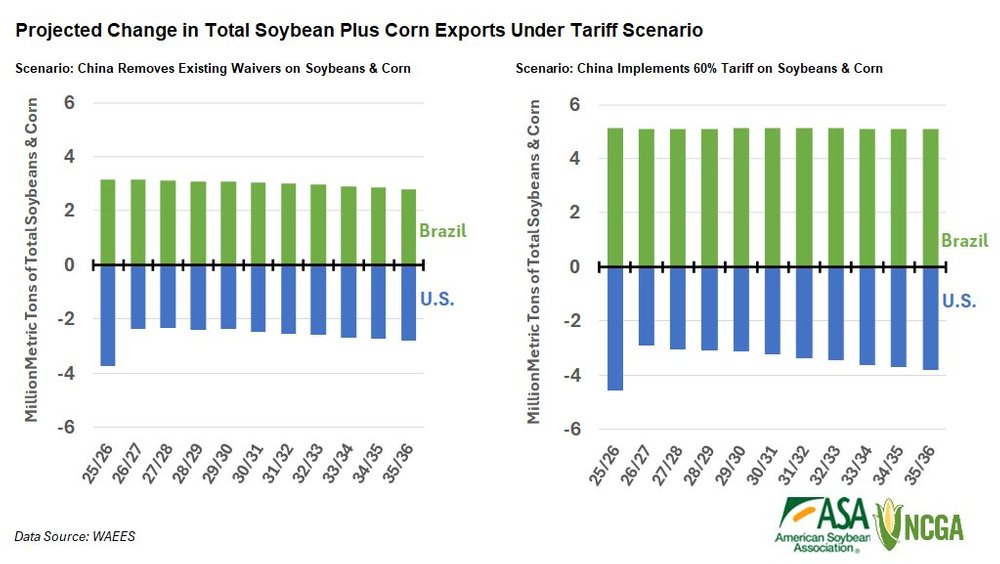

US Soybean & Corn Exports Drop While Brazil Gains Market Share

If China cancels its waiver and reverts to tariffs already on the books, US soybean exports to China fall between 14 and 16 million metric tons annually, an average decline of 51.8% from baseline levels expected for those years. US corn exports to China fall about 2.2 million metric tons annually, an average decline of 84.3% from the baseline expectation. Although the export quantity decline is much lower for corn than soybeans, reflecting the smaller quantity of corn exported to China, the relative change from the baseline quantity is significant for corn.

While it is possible to divert exports to other nations, there is not enough demand from the rest of the world to offset the major loss of soybean exports to China. At the same time, Brazil and Argentina gain global market share with increased exports. The US loses a combined total of 2.3 to 3.7 million metric tons of soybean plus corn exports annually, while Brazil gains an average of 4.6 million metric tons of soybean plus corn exports annually.

Chinese tariffs on soybeans and corn from the US but not Brazil provide incentive for Brazilian farmers to expand production area even more rapidly than baseline growth. The expansion is magnified because some land area in Brazil can be used to grow a soybean and corn crop in the same year. Land transitioned into production area in Brazil will remain in production. The impact on US soybean and corn farmers isn’t limited to a short-term price shock: This is a long-lasting ramification that changes the global supply structure.

A 60% retaliatory tariff level intensifies the shock, resulting in a loss of over 25 million metric tons of soybean exports to China and nearly 90% of corn exports to China. In this situation, the US loses a combined total of 2.9 to 4.6 million metric tons of soybean plus corn exports annually, while Brazil gains an average of 8.9 million metric tons of annual soybean plus corn exports over the projection timeline.

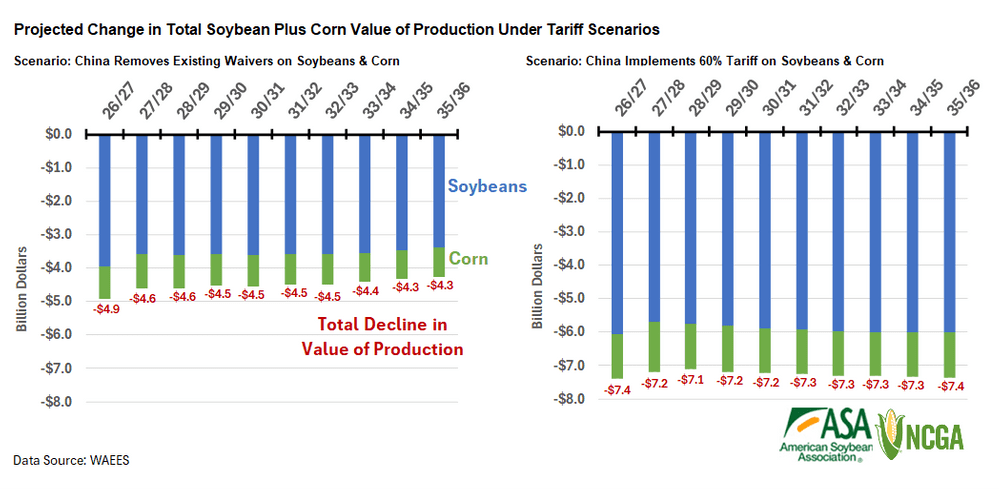

Here’s their assessment of the impact on US production in both scenarios.

In sum, farmers will see cash income decline while costs increase.

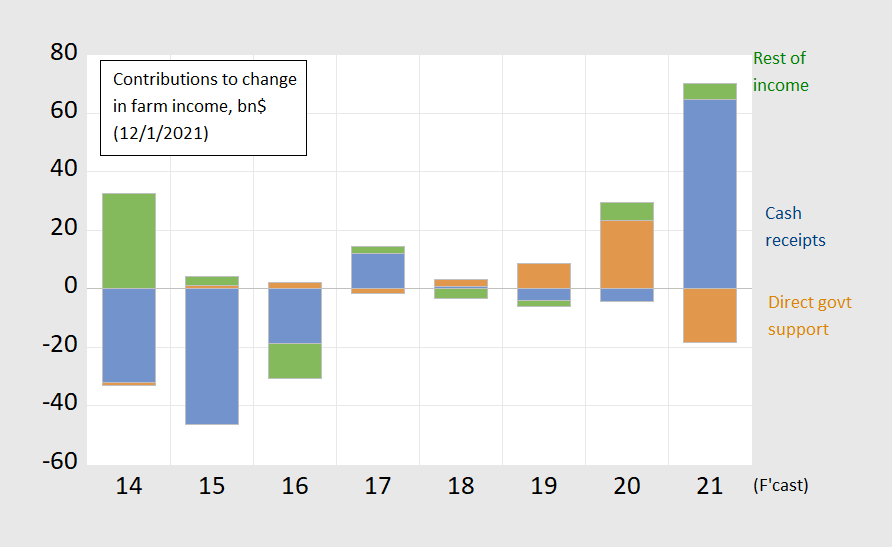

From a January 2022 post, one can see how massive a transfer the Trump administration had to implement in order to prop up farm income in the wake of that trade war, and how cash income popped up in 2021. Hence, despite lower government support, net income is forecast to be up.

Figure 1: Contributions to change in farm income from cash receipts from sales (blue bar), from direct government support (brown bar), and from all other components (green bar). Source: USDA, data of 12/1/2021.

This time around, if Trump were to impose 10-20% tariffs on everything imported and 60% tariffs on Chinese imports, then there’ll be a lot more people in line for bailouts than last time. If you believe the farmers will be first in line next round, then there’s a bridge I want to sell you.

See more on the impact on the Midwest here.

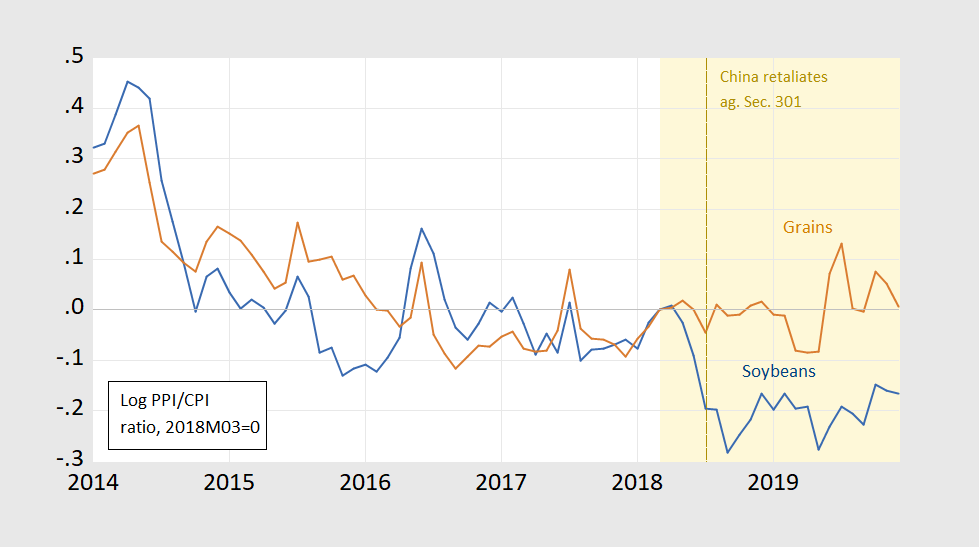

For a nostalgic trip down event-study lane, see this January 2020 post, with this graph:

Figure 2: CPI deflated PPI for soybeans (blue) and grains (brown), in logs 2018M03=0. Orange shading denotes period during which China Section 301 action was announced/implemented. Brown dashed line is when Chinese tariffs on US soybeans go into effect. Source: BLS via FRED, author’s calculations.