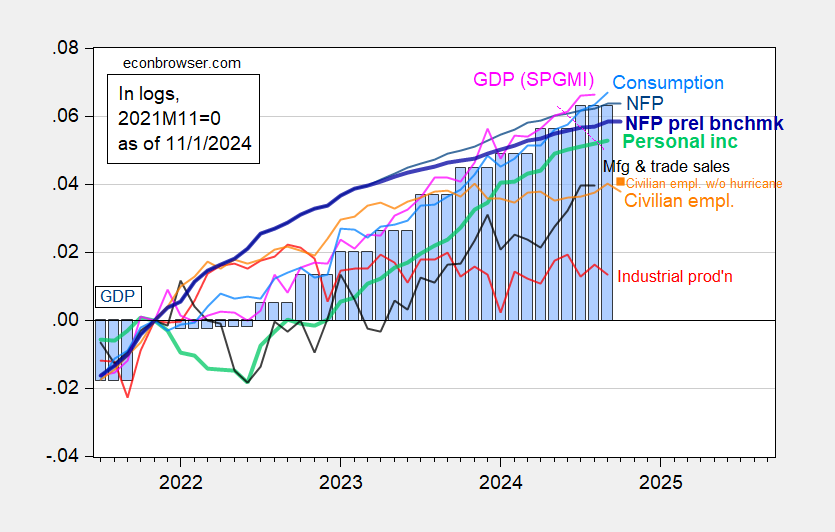

Employment for October and monthly GDP for September, in the set of variables followed by the NBER’s BCDC:

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 1st release, S&P Global Market Insights (no Macroeconomic Advisers, IHS Markit) (11/1/2024 release), and author’s calculations.

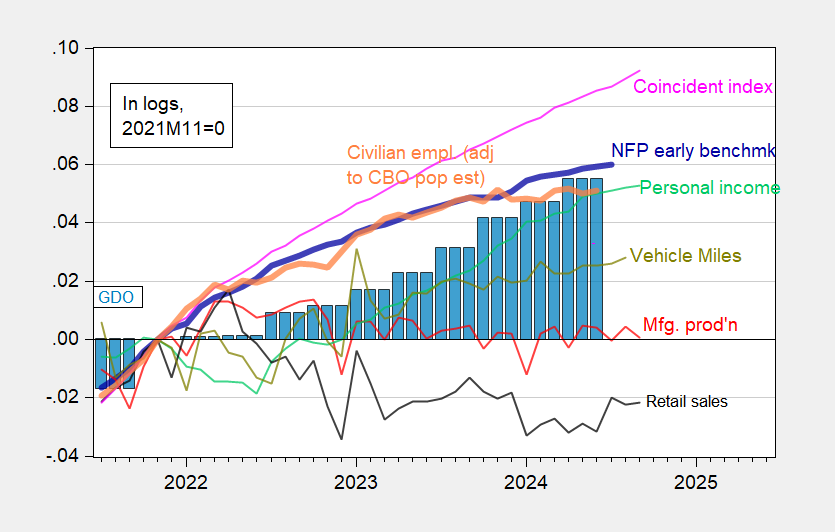

Available alternative indicators are generally up, including the coincident index for September, and vehicle miles traveled (VMT) for August.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted using CBO immigration estimates through mid-2024 (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (light green), retail sales in 1999M12$ (black), vehicle miles traveled (VMT) (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q2 third release/annual update, and author’s calculations.

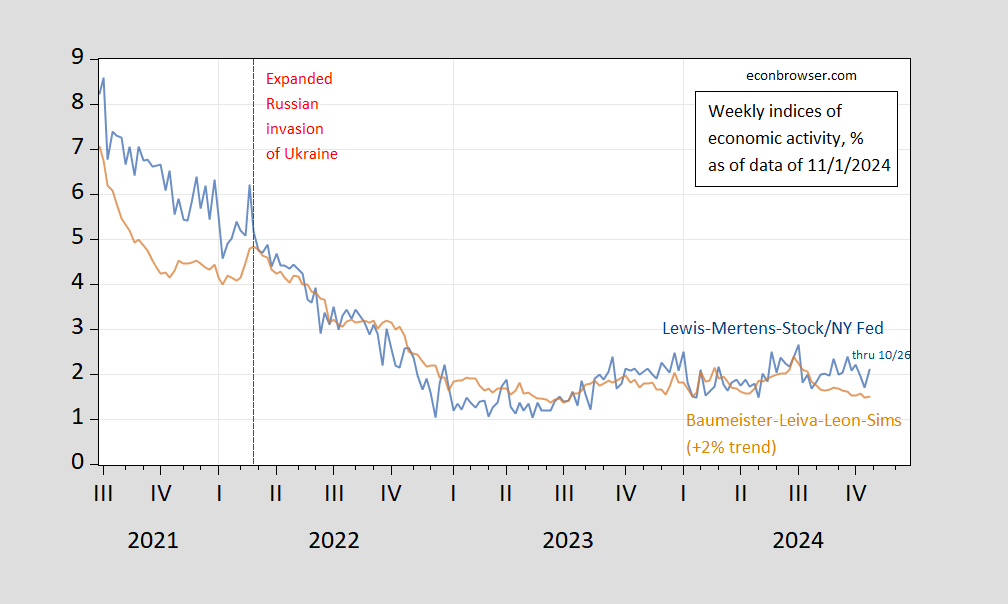

High frequency (weekly) indicators are mixed, with the Lewis-Mertens-Stock WEI at 2.1%, and the Baumeister-Leiva-Leon-Sims WECI at 1.5% (assuming trend is 2%).

Figure 3: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (tan), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 11/1/2024, and author’s calculations.

GDPNow for Q4 is at 2.3% today; NY Fed nowcast at 2.01%.