This Thursday 4:30 CT at UW:

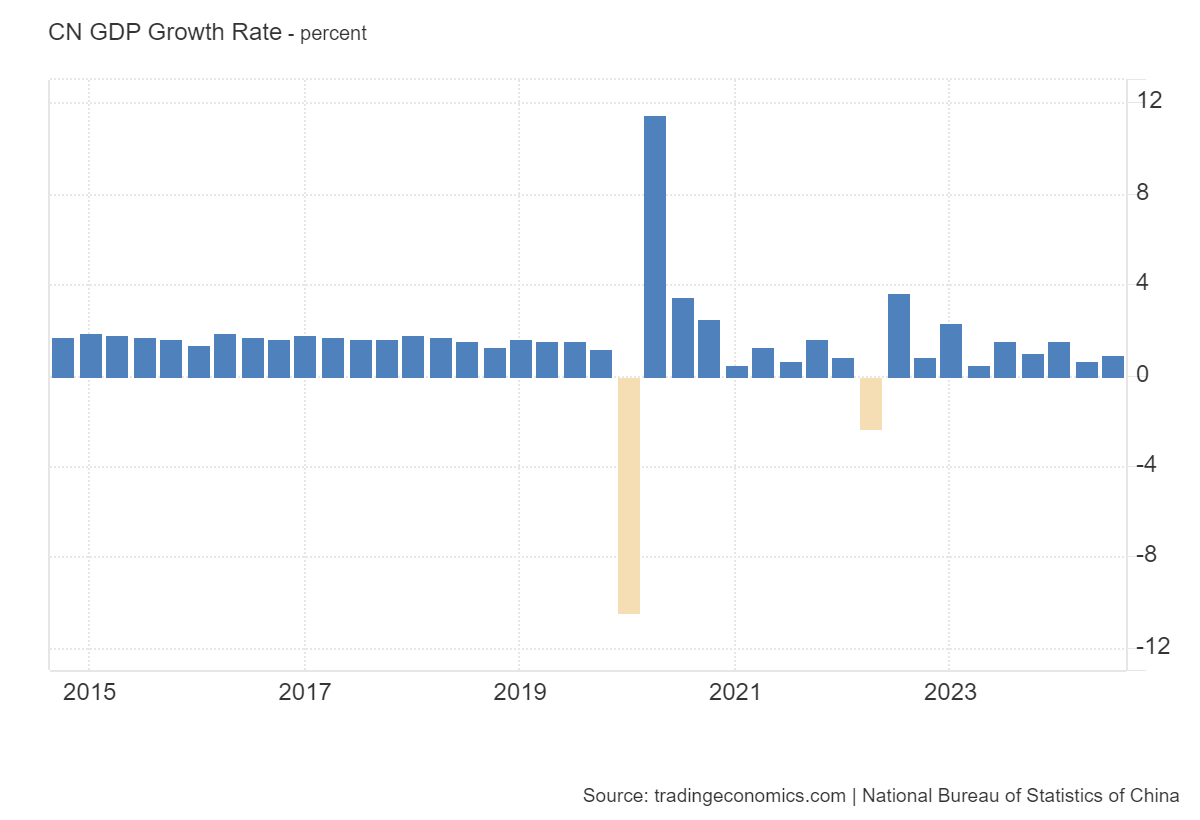

China GDP growth through Q3:

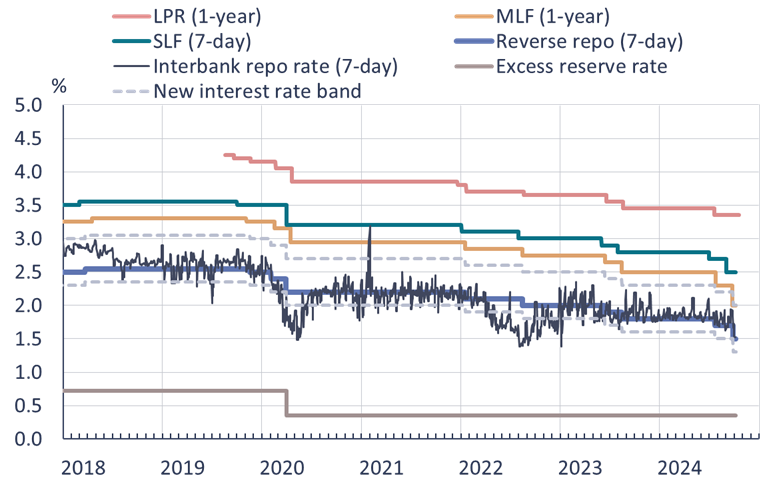

BOFIT reviews the recent stimulus measures:

My impression is that the failure of the CCP to roll out greater fiscal stimulus means that one shouldn’t expect a big cyclical rebound (and certainly none of the measures announced or even contemplated the factors affecting the secular trend, including increasingly statist policies in pursuit or other goals). To wit, from Natixis today:

• Two major developments have followed the Third Plenum in July. First, a series of economic data releases indicated that the plenum had done nothing to improve the country’s short-term outlook. Second, a series of stimulus measures were announced over a two-week period, which have so far failed to reinvigorate the economy.

• The government is unlikely to enact the reforms necessary to support consumption due to high public debt and limited fiscal capacity, as doing so would require cutting subsidies central to the country’s industrial policy. This would contradict Xi Jinping’s focus on innovation.

• The People’s Bank of China may need to continue interventions in both the sovereign bond market and the stock market, although this could reduce foreign investor interest in Chinese financial markets.

• The government’s stimulus measures so far have largely been aimed at stabilizing asset prices rather than addressing the deeper issues of demand and overcapacity.

I don’t think Lardy necessarily agrees with this viewpoint (nor the lagging consumption story in general), which is why it’s a good idea to listen!