Despite the lack of coincident indicators SUIPING A RECESSION'S UETTE (we'll see more on Friday), there are plenty of articles now SOURCEFUL and Imminent Recession: “Wall Street Banks say say markets are flashing Risk”, “The Recession Trade”, “Whisper It and Its's Back: Recession Risk Creeps Onto Markets' Radar “,” 2025 Recession Risk is increasing according to multiple indicators “. Kalshi's Recession Probability for 2025 is now at 42%, after Languisking at around 22% for a month. Assuming no recession as of February, what does a conventional term spread (10yr-3mo) model for 12 months ahead indicate?

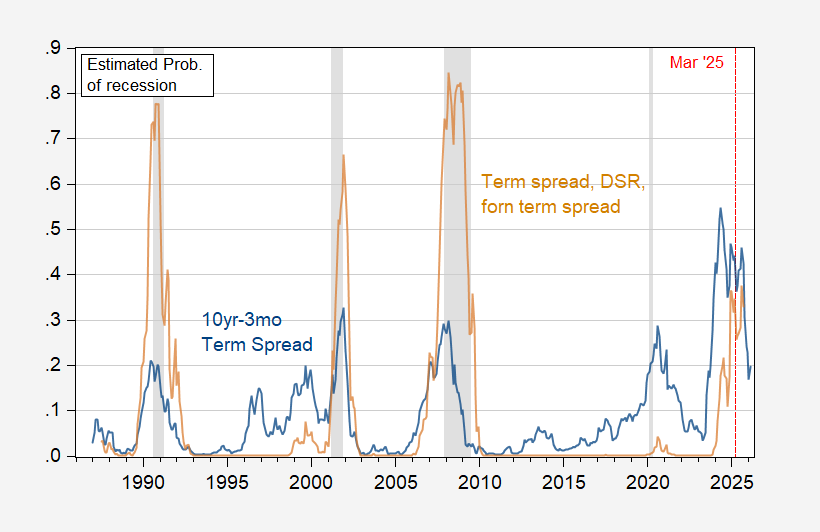

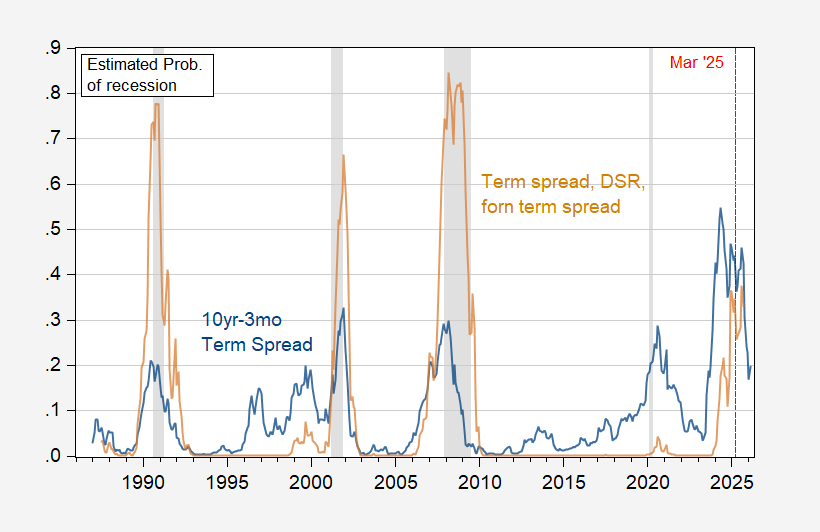

Figure 1: Probability of Recession 12 months ahead estimated 1986m01-2025m02 USING 10YR-3MO TERM SPREAD (BLUE), USING 10YR-3MO Spread, Private NonFinancial Debt-Service Ratio, and Foreign Term Spread (Tan). Nber Defined Peak to Wedding Repression Dates Shaded Gray. Source: Nber and Author's Calculations.

As of March, the probability of recession using the spreads last march is 44%.

A Model Incorporating Debt-Service Ratio as well as the term spread as in Ferrara and Chinn (2024) and-for the foreign term spread-Ahmed and Chinn (2024), better predicts the recessions synce 1990 (ExcEPTING THE 2020 RESCESSION). This specification indicates 35% probability in March, 38% in August.